The 9-Minute Rule for Lighthouse Wealth Management

Canadians interested in some help handling their cash through unsure instances might desire to consider a monetary coordinator or consultant to guide decisions on from assets for you to get out of personal debt. But because challenging as making plans for your very own funds could be, professionals say it is no quick task obtaining right help, either.“There’s still countless ambiguity, I have found, with financial advisors in copyright to determine what the heck they actually do,” states Jason Heath, managing manager of goal economic associates.

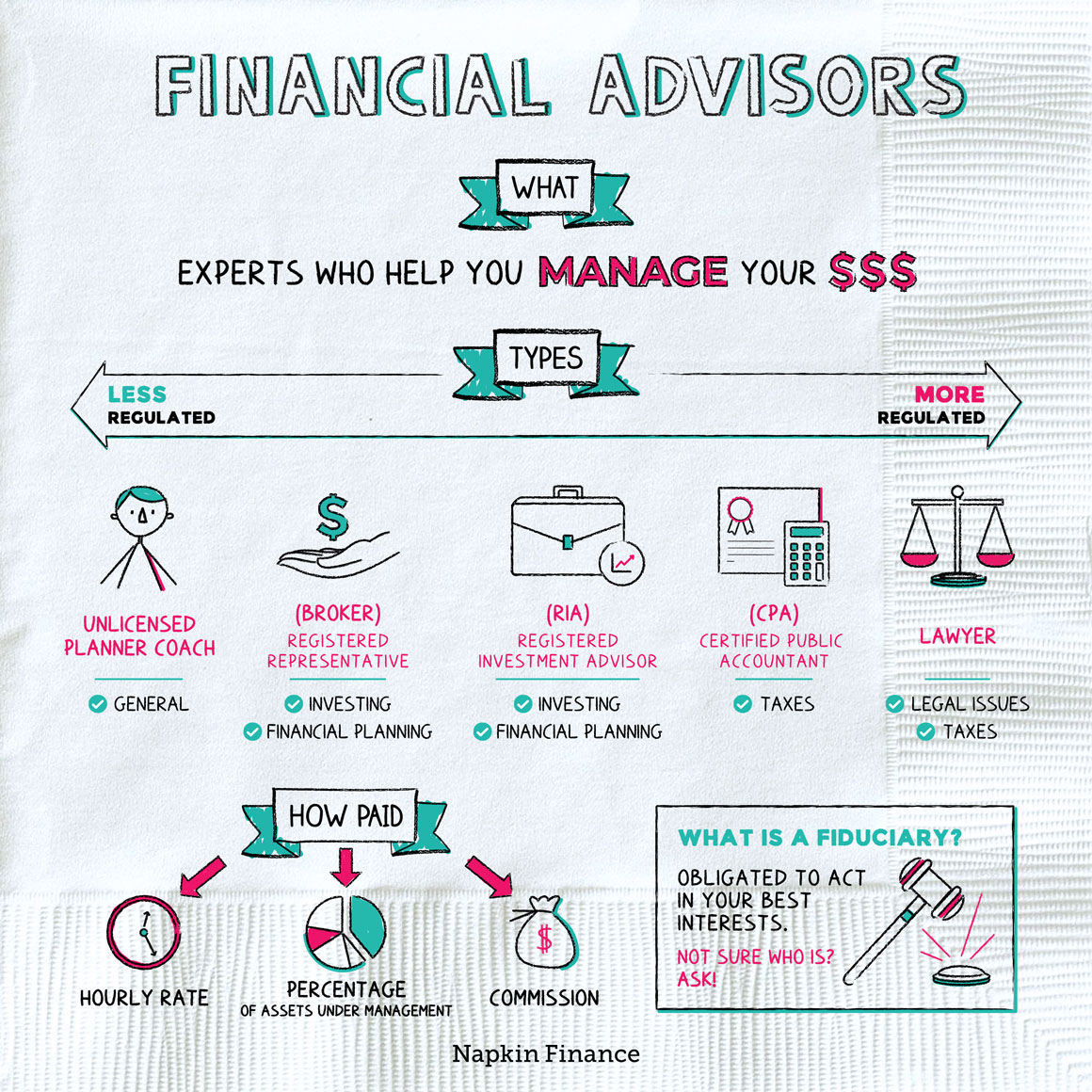

Heath can also be an advice-only planner, which means that he doesn’t manage their clients’ money right, nor does he offer them specific financial loans. Heath states the selling point of this approach to him is the fact that he does not feel certain to provide a particular product to solve a client’s cash dilemmas. If an advisor is only prepared to market an insurance-based answer to a challenge, they might end steering some body down an unproductive course when you look at the name of striking product sales quotas, according to him.“Most economic solutions folks in copyright, because they’re compensated based on the items they provide and sell, they are able to have motivations to recommend one plan of action over another,” he says.“I’ve plumped for this program of activity because i will appear my personal customers in their eyes rather than feel I’m benefiting from all of them at all or trying to make a sales pitch.” Story goes on below advertisement FCAC notes the manner in which you pay your own consultant depends on this service membership they supply.

Ia Wealth Management Can Be Fun For Anyone

Heath and his ilk are compensated on a fee-only model, therefore they’re settled like a lawyer can be on a session-by-session foundation or a per hour assessment rate (ia wealth management). According to the selection of services additionally the expertise or typical clients of one's expert or planner, per hour charges ranges for the hundreds or thousands, Heath states

This is often up to $250,000 and above, he says, which boxes completely many Canadian families from this standard of service. Story goes on below ad for many unable to spend costs for advice-based methods, and those reluctant to give up part of the financial investment comes back or without adequate money to begin with an advisor, there are a few more affordable and even free choices available.

10 Easy Facts About Lighthouse Wealth Management Shown

Story goes on below ad discovering the right economic planner is a little like online dating, Heath claims: You should find some one who’s reputable, features an individuality match and is also just the right person for all the stage of life you’re in (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1706079058&direction=prev&page=last#lastPostAnchor). Some prefer their experts become more mature with much more experience, he states, while others favor somebody younger who is able to ideally stay with them from early decades through pension

How Ia Wealth Management can Save You Time, Stress, and Money.

One of the greatest errors some body make in choosing a consultant is certainly not asking adequate questions, Heath claims. He’s amazed as he hears from consumers that they’re anxious about inquiring questions and probably showing up stupid a trend he locates is equally as normal with set up experts and the elderly.“I’m amazed, given that it’s their cash and they’re spending many charges these types of individuals,” he says.“You deserve getting the questions you have answered therefore need to have an unbarred and truthful connection.” 6:11 Financial planning all Heath’s final advice applies whether you’re trying to find external economic support or you’re going it alone: educate yourself.

Listed below are four things to consider and ask your self whenever finding out whether you ought to tap the knowledge of a monetary consultant. Your net really worth is certainly not your income, but alternatively an amount that will help you comprehend what money you earn, how much cash you save, and in which you spend money, as well.

Investment Consultant Things To Know Before You Buy

Your infant is found on ways. Your divorce or separation is actually pending. You’re nearing your retirement. These alongside significant life events may remind the necessity to check out with a financial consultant regarding the assets, debt targets, and other monetary issues. Let’s state the mother kept you a tidy sum of money inside her might.

You could have sketched out your own economic strategy, but I have difficulty keeping it. A financial consultant may offer the liability you'll want to put your monetary intend on track. In addition they may recommend ideas on how to tweak your own economic program - https://www.behance.net/carlospryce being maximize the potential outcomes

The Of Independent Financial Advisor copyright

Anyone can state they’re an economic advisor, but an advisor with pro designations is essentially the one you ought to hire. In 2021, approximately 330,300 Us citizens worked as private economic analysts, according to the U.S. Bureau of work studies (BLS). Many monetary analysts are self-employed, the bureau claims - ia wealth management. Usually, there are five forms of monetary analysts

Agents typically earn commissions on deals they make. Agents are controlled of the U.S. Securities and Exchange Commission (SEC), the economic field Regulatory Authority (FINRA) and state securities regulators. A registered expense expert, either an individual or a company, is similar to a registered representative. Both purchase and sell opportunities with respect to their customers.

Comments on “The 15-Second Trick For Investment Consultant”